What a cracker of a week (that’s technical asset management speak for: the JSE was up 5.7%) and the Rand ended 11.63 (touched 11.56) against the US$.

Local shares (especially banks) were flying! Property shares still under pressure after the “anonymous report” was released and they opened 15% lower on Monday. Where to from here for the stock market? There’s a bit of a titanic struggle happening in the US markets between the bonds, currency and equities markets.

Some good news: SA Unemployment rate was slightly down in Q4’17 to 26.7% from 27.7%.

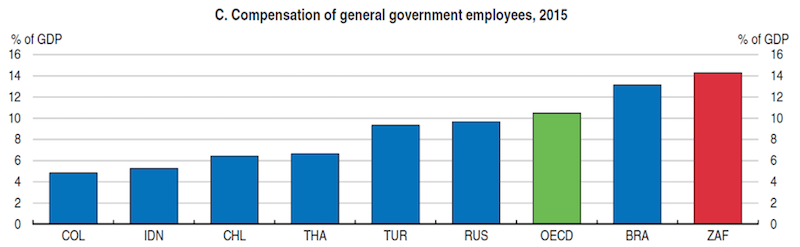

Budget coming up on Wednesday – in October the deficit was R50bn, free tertiary education could add another R40bn, as well as the still bloated cabinet (see graph below) – not to mention the other leakages we don’t yet know about. What are we expecting?

Discovery put out a trading update last week and will report results on Tuesday… already up 45% in the last year and it’s not a cheap stock on 25.8x Price Earnings ratio, but is this our “Warren Buffet style” investment? Phenomenal growth, global domination, USP (Unique Selling Point) and the KISS principle (Keep It Simple, Stupid)?

SA’s public sector wage bill now swallows nearly 35% of the budget and 14% of GDP. Not only is this way out of line with other emerging economies, it is extreme by virtually any measure – including developed economies.

Source: OECD